As millions of mortgages come up for renewal, how can you save money? Winnipeg brokers weigh in

More than two million Canadians will renew their mortgages over the next year-and-a-half. CTV News asked more than 50 mortgage brokers across Canada how to get the best mortgage deal. Here’s what we found from the four brokers we spoke to in Winnipeg.

As mortgage renewals surge across the country, CTV News Winnipeg asked several mortgage brokers in Winnipeg what residents should consider when refinancing a mortgage.

“When we look at 2023, we are actually seeing a little over 1 million mortgages that were renewed during that period,” said Tania Bourassa-Ochoa, Deputy Chief economist with Canadian Mortgage and Housing Corporation (CMHC), adding at least 2 million more mortgages will be renewed over the next three years.

According to the most recent data from CMHC, the average mortgage price in Winnipeg has been steadily increasing, sitting at $1,598 as of the fourth quarter of 2023. Winnipeg’s mortgage rates are still below the national average, which sits at $2,143.

Mortgage delinquencies have also been steadily rising across Canada, including in Winnipeg, which saw a marked increase in the past year.

Winnipeg homeowner Karen Huyghebaert said the recent interest rate increases have made her variable fixed-term mortgage difficult to manage.

“It almost feels like we’re behind again because the interest rates have gone up so much,” she said, adding that now she has to think carefully about where to spend money.

“We’re very privileged in that it’s not a huge struggle to get by,” she said, but when it comes to spending on anything beyond the basics, it’s getting out of reach for her family.

“Those extra things that people want, like maybe you want a cabin, maybe you want to go on a nice vacation,” she said, “You know, it’s more difficult to plan for those things when you’re paying more monthly for your mortgage.”

CTV News Winnipeg surveyed four mortgage brokers, asking the same questions about the type of mortgage, their best possible rate right now, getting out a variable rate mortgage, and opting for a longer amortization period.

The results were mixed across the board but all agreed a longer period to pay off a mortgage is a sound decision- depending on the economic situation of homeowners.

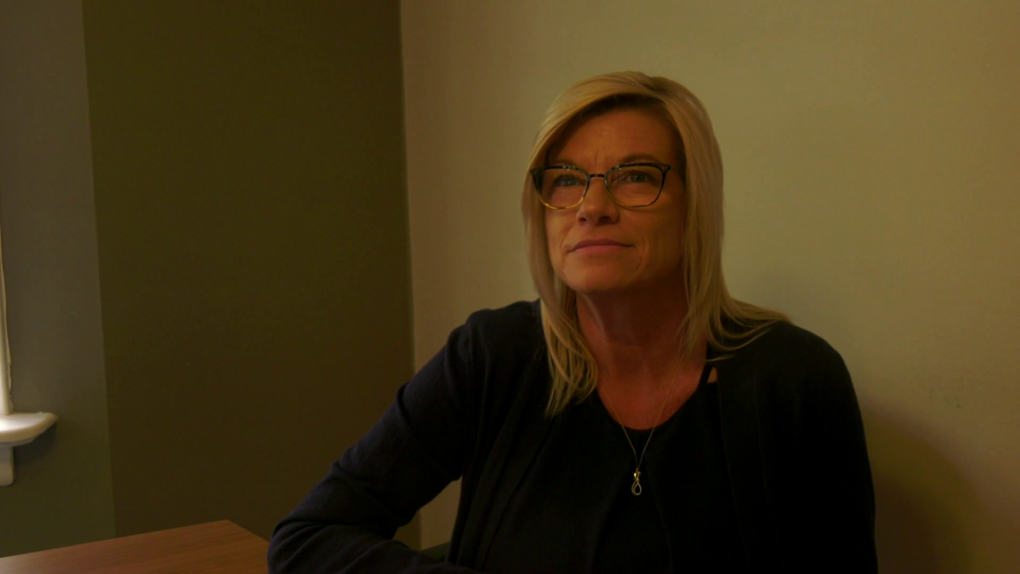

Shirl Funk speaks about mortgage renewal in May 2024. (Jeff Keele/CTV News Winnipeg)

Shirl Funk speaks about mortgage renewal in May 2024. (Jeff Keele/CTV News Winnipeg)

All mortgage brokers in Canada are governed under strict federal and provincial laws which include a requirement to report any earnings they receive from banks for client referral and getting the best rate means repeat business.

For independent broker Shirl Funk, it comes down to the individual and their level of comfort with risk and safety.

“If they can manage the affordability of the variable rate, I say stay there, because rates could drop at any time,” she said. “If you want to go fixed, you can change it then.”

Funk said she is putting clients in two to three-year rates for mortgages.

“Because of the high rates right now, we don’t want to lock them in too long, put them in a five year, and then rates all of a sudden jumped down a couple of points,” she said. “Now they’re stuck there. So we’re just doing two, three-year terms. And hopefully, rates come down, and we’ll refinance them at that time.”

Chad Wilson with Ideal Mortgage Solutions believes the worst of the rate increases are in the past and they will start falling.

“You’re about to see the other side of the pain that you’ve just gone through over the last two years,” he said. “We saw a significant increase in the benchmark rates in the Bank of Canada over the last 24 months. Those were geared at trying to tame inflation, they have done their job. And going forward, we should see the other side of this. I mean, the normalized interest rates are not going to be the pandemic-level interest rates. We need to all understand that. But certainly, we should see some reductions in that prime rate over time.”

Wilson said the most important thing for people choosing a mortgage is ensuring they’re financially stable.

“Payment stability is, is the most important consideration when renewing your mortgage,” he said. “This is a roof over your home, it’s not something you should gamble with.”

The Bank of Canada will announce the next interest rates on Wednesday morning. The Bank of Canada has held steady at a five per cent interest rate since July 2023.

If the Bank of Canada decides to cut rates, it will be the first cut since March 2020, when the COVID-19 pandemic took hold.

BEST RATE DEPENDS ON SEVERAL FACTORS

The best rate on a 5-year fixed mortgage that could be obtained right now all came in at 4.89 per cent and a variable rate topped out at 7.2 per cent but as broker Beth Thrall pointed out, it is not always about the “best” rate.

“Reason being is, with, rates come other factors,” she wrote in her survey, “Such as prepayment privileges and penalty calculations.”

Beth Thrall with Homework Mortgages powered by Mortgage Architects. (Facebook)

Beth Thrall with Homework Mortgages powered by Mortgage Architects. (Facebook)

She said that other factors like switching lenders and adding funds to your mortgage can also affect the interest rate.

Mortgage broker Ron Chan said mortgage debt is not to be gambled with.

“It provides your family with shelter and should be a boring part of your financial portfolio,” he said, “Payment stability is extremely important and that has proven itself over the past couple of years.”

All the brokers agree you should consult with a professional you trust and, the bottom line is self-education.

“Advice is great but you should ensure you are making an educated decision on your largest financial liability and largest financial asset,” Thrall said, “Reach out to a mortgage agent you trust.”

Ron Chan INVIS Mortgages. (Supplied )

Ron Chan INVIS Mortgages. (Supplied )

View original article here Source